China’s lead in artificial intelligence development is set to unleash a wave of innovation that will produce more than 100 DeepSeek-like breakthroughs in the next 18 months, according to a former senior Chinese government official quoted by Bloomberg.

The new software products “will fundamentally change the nature and technological character of the entire Chinese economy,” Zhu Min, a former deputy governor of the People’s Bank of China, said at the World Economic Forum in Tianjin, also known as the Summer Davos.

Zhu, who also served as deputy managing director of the International Monetary Fund, believes the transformation is possible thanks to China’s pool of engineers, a large user base and supportive government policies.

China’s bullish outlook for the future of artificial intelligence (AI) means that the competition for dominance in cutting-edge technology with the United States will continue. The United States sees China as a key rival in the AI race, especially after DeepSeek shocked the global tech industry in January with its low-cost but powerful model.

In addition to efforts to prevent China from acquiring better semiconductor manufacturing equipment, Washington has blocked Chinese companies from accessing high-end AI chips from Nvidia, citing national security concerns. Beijing is now pinning its hopes on domestic tech giants like Huawei Technologies Co. for advanced chip manufacturing.

DeepSeek’s success has sparked a rally in Chinese technology stocks, fueling optimism about China’s competitiveness despite trade tensions with the Trump administration and economic challenges at home.

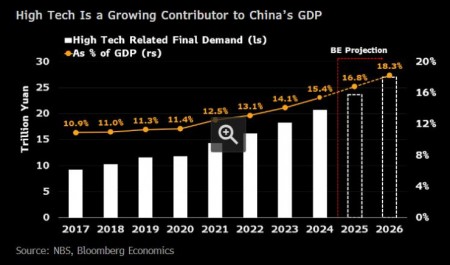

Bloomberg Economics estimates that the contribution of high-tech to China’s gross domestic product (GDP) has risen to about 15% in 2024 - from about 14% a year earlier - and could exceed 18% in 2026.

Despite a temporary truce in the trade war agreed with the United States a month ago, U.S. tariffs remain high and the prospects for a lasting solution remain in doubt. Analysts surveyed by Bloomberg forecast GDP growth to slow to 4.5% this year, well below the official target of about 5%. It grew by 5.4% in the first quarter.

“Uncertainty over U.S. tariff policy is an important factor that could lead to negative growth in global trade this year,” Zhu told reporters on the sidelines of the forum. “The entire trade and industrial chain has started to slow down, investment has started to stop, so the impact is bigger than the actual tariff rate,” he added.

Zhu also said the US is likely to see an acceleration in inflation from August as it takes some time for the tariffs to impact the economy and for companies to deplete the inventories they had built up before Trump increased the levies.